- عربي

- Call Us: (+974) 4484 0000

- Info@qiib.com.qa

- Personal Internet Banking

- Corporate Internet Banking

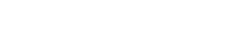

QIIB announces a major update of its Mobile Banking Application

- Among features provided is the ability to request postponing installments and repay the financing

- Omar Abdulaziz al-Meer: We are committed to provide the best digital banking solutions to our customers

QIIB announced the launch of an innovate update for its mobile banking application, which is meant to enrich the banking experience of its customers with many more services, round the clock.

Such updates go along with the latest technological developments in the field of digital banking.

Thanks to the new update, QIIB customers can now benefit from more features such as availing of new services through the app in addition to the various services available currently.

Moreover, key security features such as access to the application through fingerprint and face identity technique have also been provided.

The main services that the customer may now get through the latest update include unblocking the amount in the account, requesting a swift copy, applying for a debit card, seeking re-issuance of a credit card, requesting temporary increase in credit card limit, balance statement in US dollars, IBAN number, proof of residence certificate, account statement, salary balance statement, request for deferral of installments, settlement of a personal finance/car finance among other features.

On the occasion of launching the QIIB mobile banking application update, Mr Omar Abdulaziz al-Meer, Head of Business Development at QIIB stated, “We are committed to provide the best banking solutions to our customers, especially the digital ones, so as to help them easily obtain the best banking technological achievements offered worldwide”.

He said, “We have launched our strategy for the development of the technological infrastructure at an early stage, and we have significantly invested in the alternate channels. This is taking into account the extensive usage and popularity of QIIB’s alternate channels. These endeavours will continue uninterruptedly in a way that provide our clients with all the desired advanced services in this digital era”.

Mr Al-Meer also confirmed, “The past period revealed the importance of alternate channels and the importance of investing in these, since alternate channels enabled the clients to obtain different banking services without the need to depend on the bank branches. It is worth mentioning that the alternate services – mainly mobile banking – represents a distinguished solution, which aims to decrease the operational costs and improve overall performance and efficiency, while also helping clients get the required services quickly”.

It is worth mentioning that QIIB mobile banking became an integral banking platform that provides services to the clients, round the clock and at any place.

At the same time they can pursue seeking details of their accounts and manage them completely, while also transferring funds internally and externally, managing their cards – whether debit or credit, settling service invoices, cheque books request and statements of account, along with many other services.

Clients may download QIIB mobile banking app or update the current application through Google Play or App Store, or through the settings option in the QIIB mobile banking app, which is already installed on their mobile phones.